Introduction

This article summarizes the latest cost rates, procedures, and precautions as of 2025.It is necessary to allow enough time and money for customs clearance of motorcycles, which has recently become very strict due to various reasons.

It also includes content that is useful when touring in Japan and sending bikes overseas.

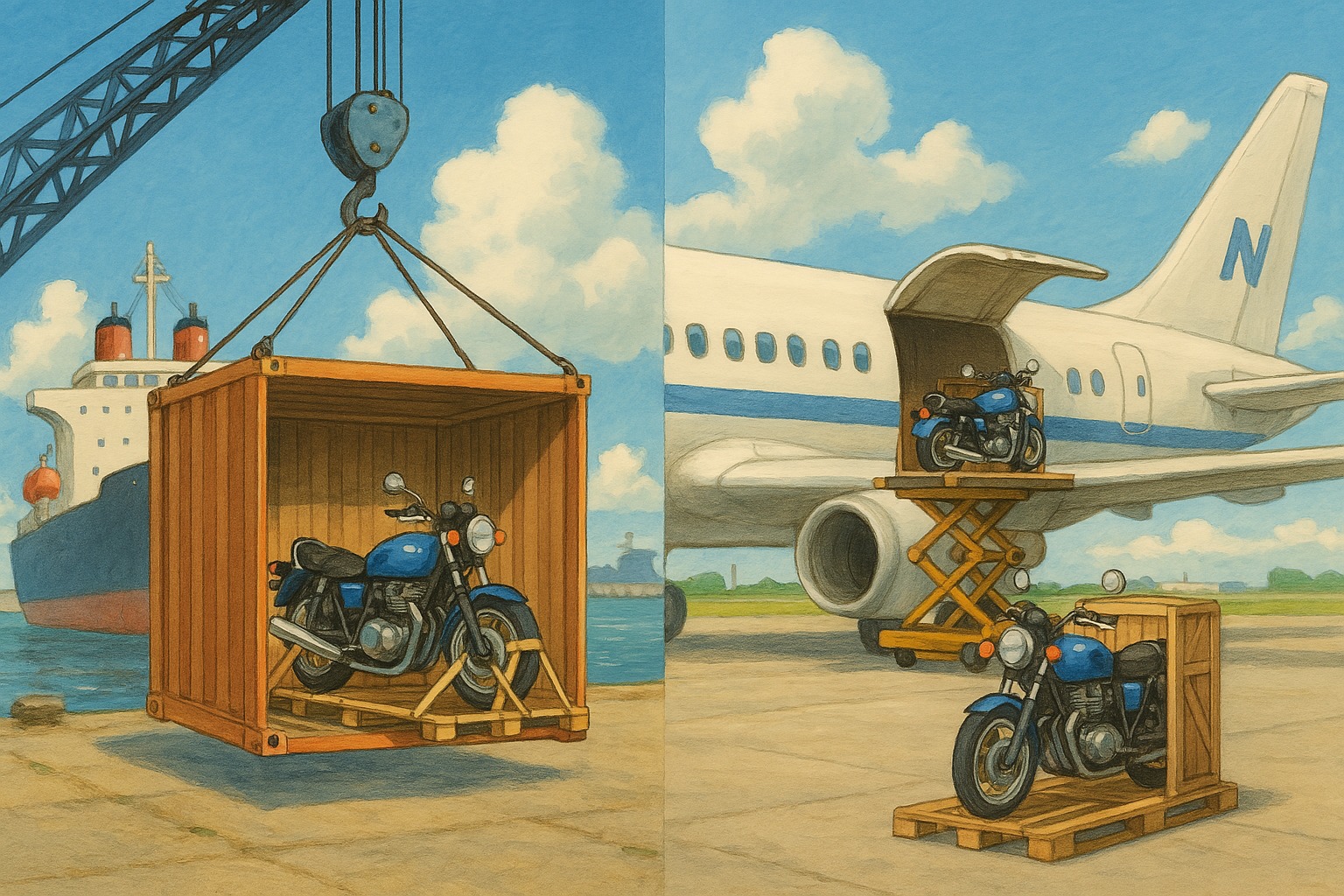

Comparison chart of transportation methods

| Distinctions | Sea Transportation (LCL Mixed Load) | Sea Transportation (FCL 20ft) | Ro-Ro Ship | Air Transportation |

|---|---|---|---|---|

| Cost | 200,000- yen per car (short-distance Asia) / 30,000- yen per car (Europe and America) | 500,000- yen per vessel (60,000- yen per vessel with 8-10 cars loaded) | 120,000- yen (Southeast Asian routes) | 500,000- yen |

| Number of days required | 3-6 weeks (shipping route + customs clearance) | 3-6 weeks | 2-5 weeks | 3-7 days |

| Advantages | Small lot / Low cost | Very low unit price for mass transportation | No need for packaging / Can be transported on the road | Fast by far |

| Disadvantages | Higher port fees | Expensive for only one vehicle | Limited shipping routes | High cost and hazardous material regulations |

Remarks:

- In recent years, the cost of transporting motorcycles has increased significantly. Estimates are required on a case-by-case basis, including import/export availability.

- Ro-Ro (Roll-on/Roll-off) transport is a ferry-type dedicated car carrier that does not require container packing, making it easier to keep costs down, but is generally only available through Korean, Chinese, and Russian routes.

- Container transportation tends to be more expensive when shipping only one unit, and it is safe to expect a total cost of 250,000 yen or more, including packing, customs clearance, and port fees.

- Air service is speed-oriented but costly.

◆ Total simulation (e.g. Yokohama → Hamburg, Germany / 1 LCL)

| Breakdown | Amount (yen) |

| Ocean freight | 250,000 |

| Packing and port charges on Japan side | 100,000 |

| Customs clearance in Japan (on behalf of the consignee) | 40,000 |

| Marine insurance | 10,000 |

| Japan side total | Approx. 400,000 yen |

| Hamburg side D/O and port fee | 40,000 |

| German VAT (19%) | Approx. 230,000 |

| German customs duty (6%) | Approx. 72,000 |

| Inland delivery (Hamburg to Berlin) | 30,000 |

| Total for Germany | Approx. 372,000 yen |

| Estimated total amount | Approx. 772,000 yen |

Overseas touring using temporary exports

Unlike permanent exports, “temporary customs clearance” is based on the premise that the vehicle will be brought back to Japan within a certain period of time.It is necessary to obtain a Customs Clearance Certificate for Private Vehicles (Carnet).

- Carnet de Passages en Douane (Carnet : Carnet de Passages en Douane) is a customs clearance document based on the Convention on the Temporary Importation of Motor Vehicles for Private Use.

- When traveling between countries that are signatories to the Convention, import/export customs clearance can be easily and quickly completed under the guarantee of Carnet, without having to prepare customs clearance documents each time.

- In Japan, JAF (Japan Automobile Federation) is the issuing authority.

- Validity: 1 year (replacement application possible).

- A customs stamp is stamped at each border crossing, and the deposit is refunded if fully digested upon re-entry.

◆ Carnet vs. Permanent Export (Comparison)

| Item | Carnet (CPD) | Permanent Export |

| Cost | Application fee + deposit (refundable) | Transportation fee + duties and taxes |

| Customs clearance | Duty Free at Temporary Customs Clearance | Taxation and registration in the importing country |

| Validity period | 1 year (replacement application possible) | No limitation |

| Country of registration | May drive with Japanese license plate number (depending on country) | Re-registered in the country of import |

| Suitable Cases | World touring/rally competition | Migration / Sales / Local Residency |

Japanese touring using temporary imports

When using Carnet

- Temporary Import Procedures

Apply to the Japan Automobile Federation (JAF) for “Application for Certification of Temporary Import Documents” (Customs Form V No. 1000) to obtain a certificate.JAF certification requires an appointment in advance. Branch offices offering Carnet de Passage authentication. - Re-Export Procedures

Declaration is made with the carnet to the vehicle.A copy of the carnet will be issued by customs as an export permit, and upon receiving confirmation that the vehicle has been shipped on this document, the vehicle can be exported.

- Import/Export Procedures (Foreign Carnet) Using Private Vehicle Customs Clearance Book (Carnet) : Customs

- Application for Certification of Temporary Import Documents (V1000)

Temporary import/export permit (TIP) by international ferry

Vehicles temporarily imported or exported by ferry between Japan and foreign countries can clear customs duty-free with a Temporary Automobile Import/Export Declaration (C5014) instead of the Carnet.

- Temporary Import Procedures

Fill out two copies of the “Declaration of temporary importation or exportation of motor vehicle” (Customs Form C 5014) and report to Customs.When import is approved, one copy will be issued as an import permit, which is required for re-export. - Re-export procedures

Submit the import permit as an export declaration.The Export Permit will be stamped and issued as an Export Permit.

* If the ferry is not used for export, submit the normal export declaration along with the import permit and request that the customs office at the port of import be notified.

Temporary exports are in reverse order. These routes are Osaka, Kobe, Sakaiminato, Shimonoseki, and Hakata ports.

- Regarding Customs Procedures for Private Vehicles Exported and Imported via International Ferry Services (Customs Directive No. 849)

- Declaration of temporary importation or exportation of motor vehicle (C5014)

Checklist of Preparation before Export

- Vehicle inspection: Check for oil leaks, brake fluid, and tire pressure to reduce the risk of fluid leaks during transportation.

- Cleaning (removal of mud and plant seeds): This is especially necessary for countries with strict phytosanitary requirements, such as New Zealand and Australia.

- Gasoline removal: Complete removal / Air transport → + tank ventilation.

- Battery terminal insulation: Tape wrapped around positive side to prevent short circuit during transportation.For lithium-ion, attach UN3481 label. Shipping may not be authorized.

- Fixed moving parts: handle lock, mirror folding, side stand storage (fixed with belt in wooden frame).

- Removal of accessories: separate packaging is recommended for side cases, accessory cabinets, etc.

- Photographs: Four exterior surfaces, meter values, and VIN number sections should be taken as evidence for damage insurance claims.

- Documents pre-check:

- Original vehicle registration or proof of transfer

- Export Cancellation Provisional Registration Certificate (after cancellation)

- Identification documents (passport/license)

- Invoice/Packing List

- Spare key management: one key is secured in the vehicle and the other is placed in a document bag (to prevent loss).

- Transport insurance: 0.5-0.8% based on CIF value, covering total loss + damage.

Export Procedures and Required Documents (Japanese side)

- Provisional export cancellation registration (Transport Branch Office)

- Customs documentation

- Invoice/Packing List

- Proof of transfer with VIN number

- Tax Returns ⇒ Export License

- B/L Issued / Insured by marine insurance

Customs clearance and taxes on the importing country side

- Customs: 0-20% of vehicle value

- Excise tax/displacement tax: weighted for displacements over 750 cc in many countries

- VAT/GST: 12-25% (based on CIF value including duties, etc.)

- Environmental and safety standards: Euro 5 emissions, etc., lighting standards, ABS obligations, etc.

Local pickup option

- CFS pickup (lowest price)

- Door to Door (DDP): +¥80,000-150,000 including customs clearance and delivery

- Airport pickup + temporary license plate (convenient for starting touring in Europe)

Frequently Asked Questions (FAQ)

Q1: I am concerned about emission regulations.

A:Euro5 conformity is mandatory for EU/UK.If proof of conformity cannot be obtained with Japanese specifications, local modification or entry may be denied.

Q2: Do I need to drain the gasoline completely?

A: Sea transport is below level 5 cm, and for air transport, complete removal + tank ventilation is mandatory under the Civil Aeronautics Law.

Q3: How much is transportation insurance?

A: 0.5-0.8% of the vehicle value is the standard (total loss plus damage cover).

Q4: If the price of the bike itself is low, is it more profitable to buy locally?

A: Yes.If the total cost including transportation, customs clearance, insurance, and taxes is at least 250,000-400,000 yen, it is often cheaper to purchase a used vehicle locally if the vehicle price is less than 500,000 yen.Especially in regions with abundant distribution such as Europe and North America, we recommend that you compare the costs including local market prices and registration fees.

We hope this article will be helpful to you in your international motorcycle life.

List of abbreviations and terms

| Abbreviations | Phrase | Meaning/Japanese translation |

| LCL | Less Than Container Load | コンテナ混載便(1台から可) |

| FCL | Full Container Load | コンテナ1本貸切 |

| Ro‑Ro | Roll‑on/Roll‑off | 自走式フェリー型貨物船 |

| CFS | Container Freight Station | コンテナ貨物集配センター |

| B/L | Bill of Lading | 船荷証券(輸送契約書) |

| D/O | Delivery Order | 荷渡指図書(現地での貨物引換状) |

| CIF | Cost, Insurance & Freight | 貨物代+保険+運賃込み条件 |

| DDP | Delivered Duty Paid | 関税・税金込ドアツードア条件 |

| VAT | Value Added Tax | 付加価値税(欧州等) |

| GST | Goods and Services Tax | 消費税(豪州・NZ等) |

| ET S | Emissions Trading System | EU排出権取引制度(海運も対象) |

| UN3481 | ― | リチウムイオン電池含有機器の国連番号 |

| Euro5 | ― | 欧州排ガス規制第5次基準 |

| CoC | Certificate of Conformity | 欧州型式適合証明書 |

| CPD | Carnet de Passages en Douane | 国際通関手帳(一時輸入用カルネ) |

Please inquire here